Providing clarity and confidence

to navigate financial decisions with

care, precision, and purpose.

We believe in informed and disciplined investing that

is structured to meet each of our clients’ unique objectives.

We develop individualized investment strategies based

on careful research and comprehensive planning. By working

to avoid loss of capital, we give your assets more room to grow.

How We Are Different:

Open Architecture

Unbiased Investment Solutions,

Tailored for You

Private Market Access

Connecting You to a Broad Universe

of Alternative Investments

Advanced Reporting

Providing Clarity Through

Comprehensive Insights

Fiduciary Responsibility

Acting in Your Best Interest

to Avoid Conflicts of Interest

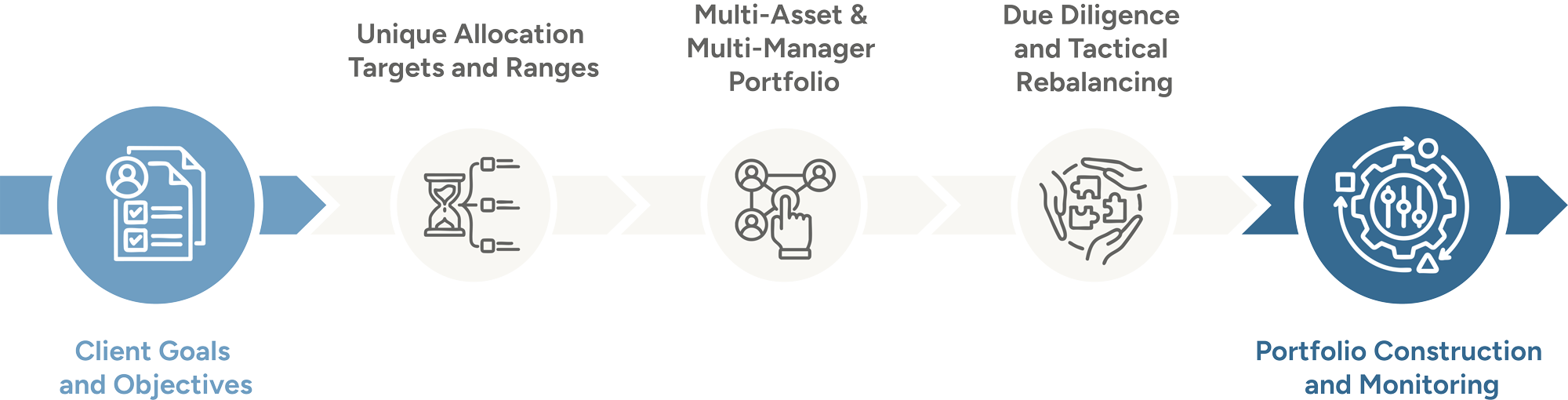

Our Approach:

We tailor solutions to align with our clients’ goals, focusing on minimizing risk, enhancing diversification,

and maximizing overall investment returns to a client’s approved level of risk.

Client Goals and Objectives

Each client is unique. Developing a comprehensive understanding of expectations, time horizon, risk tolerance, and restrictions is essential for crafting a thoughtful investment policy statement or refining existing guidelines.

Unique Allocation Targets and Ranges

Each client’s needs and risk tolerance drive an efficient and personalized allocation strategy. Flexibility within a portfolio’s asset allocation allows for tactical adjustments based on valuations and changing market conditions.

Multiple Manager Portfolio

Our clients benefit from access to a diverse and curated group of investment managers across all asset classes. With no predetermined selection, we continuously evaluate new strategies and firms to ensure the best fit for each client. Every strategy is thoughtfully integrated into the context of the client’s total portfolio and aligned with their unique investment objectives.

Due Diligence and Tactical Rebalancing

We diligently keep portfolios aligned with their target allocations. Periods of market mispricing and timely rebalancing provide opportunities to enhance overall portfolio performance. Comprehensive manager oversight ensures transparency and helps mitigate unexpected risks.

Portfolio Construction and Monitoring

Financial markets are constantly evolving, and we adapt by continually seeking the best strategies and managers while conducting rigorous, ongoing due diligence on existing ones. Our customized reporting and communications are designed to be both clear and relevant, ensuring clients stay informed and confident in their portfolio’s performance.